At Vital Direction, we continuously analyse market trends to provide our clients with cutting-edge insights. Today, we’re focusing on Apple Inc. (AAPL), a stock that has been attracting significant attention from investors worldwide.

Current Analysis: The Bottom and the Upswing

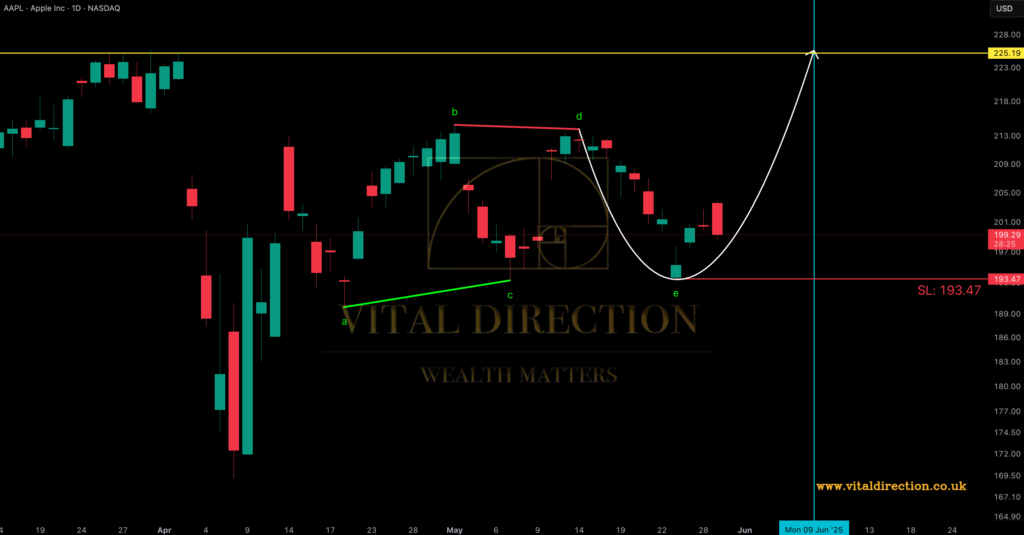

Since the bottom of April 8, Apple stock has shown promising signs of recovery, bouncing back from the $169 level. This upward movement appears to be the initial phase of a larger trend. Our technical analysis suggests that this uptrend corresponds to an A wave in the Elliott Wave Theory.

Consolidation Phase: The ABCDE Triangle

Following this initial surge, Apple stock entered a consolidation period, which we interpret as a contracting triangle pattern—an ABCDE formation. This pattern indicates a period of indecision in the market, often preceding a significant price move. Our analysis indicates that the E wave of this triangle concluded around the $193.47 mark.

Future Outlook: Aiming for $225

As we look ahead, our projections for Apple stock are optimistic. We anticipate a potential rise to $225, provided the $193.47 level remains unbreached. This target is based on our technical analysis and market conditions. Our forecast suggests that this upward movement could materialise around June 9, 2025. However, it’s essential to remain vigilant, as broader market dynamics, particularly with the S&P 500, could influence Apple’s stock performance in the longer term.

Conclusion: A Great Risk-Reward Opportunity

In summary, Apple stock presents an exciting risk-reward opportunity. As long as the $193.47 support level holds, we expect significant upward movement towards the $225 mark by mid June 2025. Stay tuned to Vital Direction for more expert market insights and updates.

Join Vital Direction to stay updated with our comprehensive market analyses and insights as we navigate these exciting developments in the financial markets.

Discover more from Vital Direction

Subscribe to get the latest posts sent to your email.