WTI Crude Oil has reached a fascinating moment in its long-term structure, and at Vital Direction, we believe the market may be standing at the very edge of a powerful bullish transformation.

By combining Gann Theory, Elliott Wave analysis, and multi-timeframe structural readings, the evidence is building for a potential long-duration cycle that traders and investors simply cannot afford to ignore.

A Market at a Turning Point

WTI has spent several years digesting the explosive rally from the pandemic low in 2020 to the 2022 peak near $130. That correction now appears mature, stabilised, and technically exhausted. The market is showing early signs of accumulation, hinting that a larger structural shift may be underway.

Traders watching oil closely will recognise that such moments often precede decisive directional moves — and the bigger the timeframe, the bigger the opportunity.

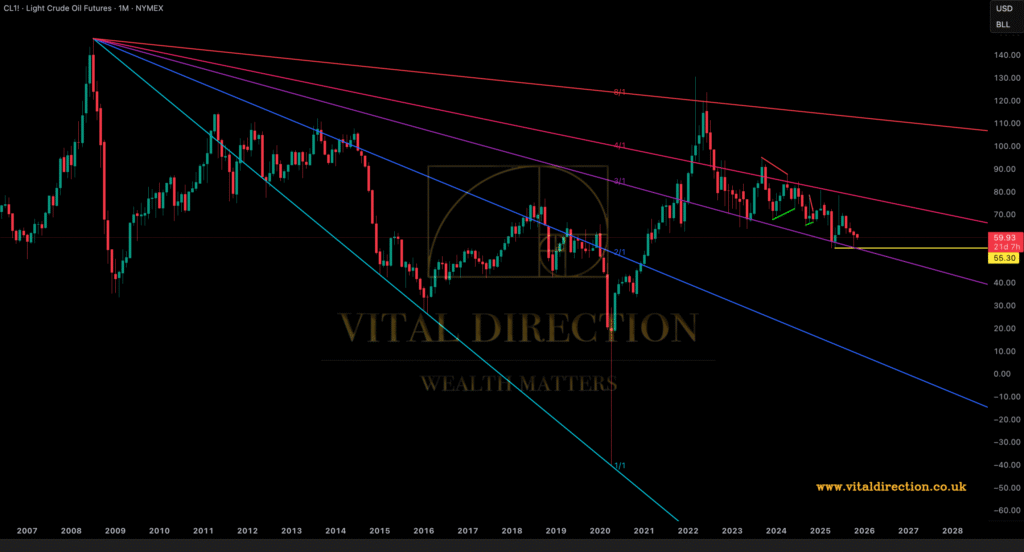

Monthly Chart: Gann Structure Turning Bullish

From a Gann perspective, WTI remains firmly supported by the 3/1 Gann angle, a level historically associated with long-term trend stability.

Should the market deliver a monthly close above $70, it would mark the first technical signal of a bullish breakout forming.

Even more compelling: a decisive push above the 4/1 Gann angle would suggest the market is preparing for a sustained, multi-year advance.

Breaking the $130 barrier, last touched in 2022, would officially open the gate to what can only be described as a new bullish super-cycle.

Gann cyclical timing aligns this next major peak within three key windows:

- December 2027

- July 2029

- November 2031

These dates represent major energy points in the long-term oil cycle — moments where significant highs have historically formed.

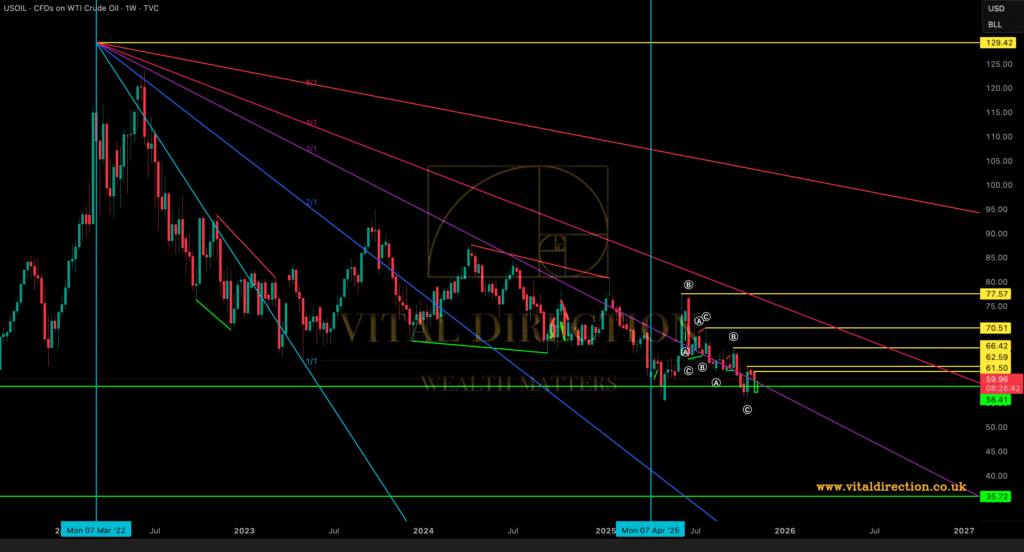

Weekly Chart: Gann Timing Aligns Perfectly

The weekly structure strengthens the bullish narrative.

The Gann cycle from March 2022 to May 2023 projected a meaningful low forming in April, and the market indeed bottomed precisely at that time.

Price continues to defend the $55.15 low, a critical level that marks the culmination of the long correction and the beginning of a new base.

Holding above this area keeps the bullish blueprint intact.

Elliott Wave Outlook: The Correction Appears Complete

From an Elliott Wave perspective, the market’s structure is remarkably clean:

- The rally from April 2020 to March 2022 forms a textbook 5-wave impulsive advance.

- The decline into April 2025 unfolds as a clear ABC corrective sequence.

This combination strongly suggests the corrective phase is finished, and the market has transitioned into a fresh accumulation zone.

When 5 waves up are followed by an ABC, the next move is typically another impulse — often larger and stronger than the previous cycle.

This aligns perfectly with the long-term bullish case.

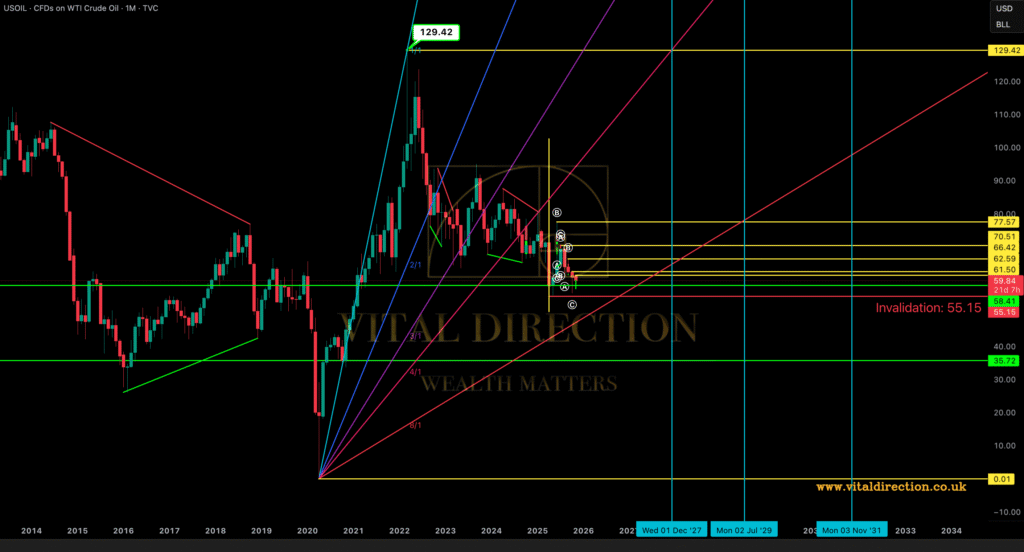

Could WTI Really Reach $200?

With Gann geometry, long-term cycle timing, and Elliott Wave structure all pointing in the same direction, the potential for WTI to reach new all-time highs is increasingly credible.

A confirmed breakout above $130 could ignite a move toward:

✅ $160

✅ $180

✅ Possibly even $200

— levels aligned with historical energy cycles and modern structural targets.

Such a move would reshape global markets and produce remarkable opportunities for prepared traders.

Vital Direction Final View

The evidence across all major timeframes suggests that WTI Crude Oil has likely completed a multi-year correction and is now building the foundations of its next major bullish cycle.

- Above $70: early breakout signals begin

- Above $130: the new super-cycle is confirmed

- 2027–2031: the next projected major cycle peaks

- Upside potential: new all-time highs, possibly reaching the $200 region

This may be one of the most important long-term energy opportunities of the decade — and at Vital Direction, we’re committed to guiding you through every stage of the journey.

Join Vital Direction to stay updated with our comprehensive market analyses and insights as we navigate these exciting developments in the financial markets.

Discover more from Vital Direction

Subscribe to get the latest posts sent to your email.